|

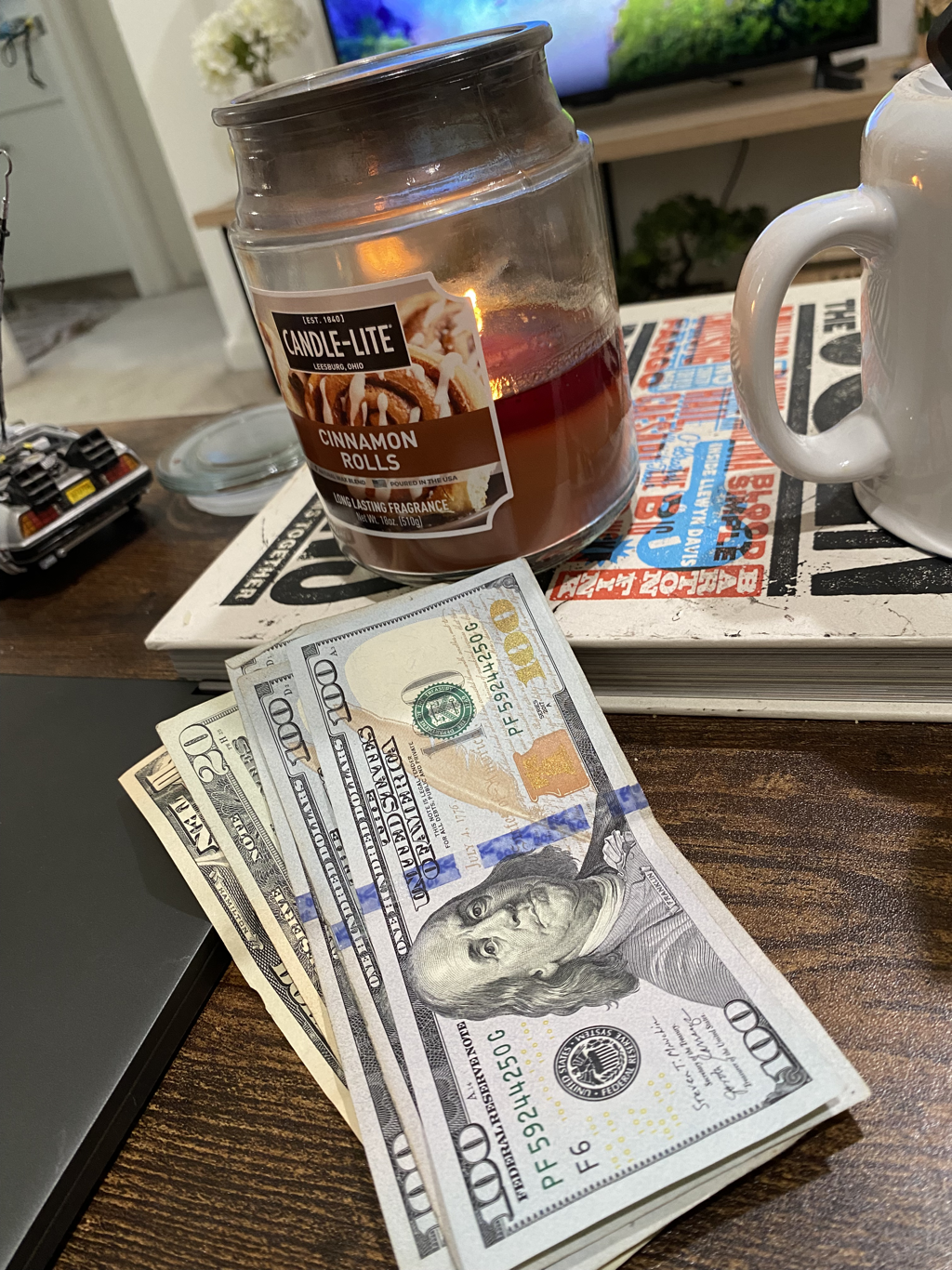

In 2021 I was facing the scariest moment of my life. Two July's ago I had a near death experience in the form of massive heart failure. Dripping in sweat, pain through all my body, and an ever present sense of doom lurking over me, I was told I would had only 6 months to live had I not come to the emergency room that fateful day. Massive heart failure is no joke. After getting out and having a fresh lease on life, I began looking at everything differently - dating, career, and especially money. This lead me down a rabbit hole of dealing with my debt, taxes, and my problem with credit cards. Eventually, I cleaned up everything, but as I talked with other comics I began to realize that many have little to no financial literacy. So, with Tax Day (April 15) coming up, I thought I'd help give some advice that might save you from the bank account and debt depression I was facing. Because if you know it or not, not taking care of your finances can be a crime, and if there's one group you don't want to ignore, it's Uncle Sam and the IRS. We're Talking About Taxes Taxes are not fun to talk about, but when you think about all the contract and independent work comics and other artists deal with, it is important to address this issue - if only to save you some money and potential jail time. If you don't know how serious paying your taxes is, you can go to jail for not filing and have heavy fines for not paying. The government can put leans on property, go into your bank account, and garnish your wages. I know the last one from personal experience. So, I'm writing this to save you all the headaches I've dealt with. While some people haven't paid or even filed in years, just know, when the government does catch you, it won't be pretty. And all it takes is a vendor who paid you to get an audit and your name pops up. Then Uncle Sam is knocking on your door. Being an Artist Means You're Broke One Day, Rich the Next The struggle with most artists is that they are paid sporadically. One day they make a few hundred to thousands in a gig, the next two months, they're begging family for a couple bucks. When the pandemic hit, the ones who had been paying their taxes got $600 plus unemployment benefits and made more money than they had in their life. I know, because the comedy school I was running got a huge boost in 2020 from young comics with disposable income and I had dropped the pricing from $395 to $195 ($150 for some) and everyone told me they could only afford it because of the stimulus checks. This is why I encourage artists to keep to cash flow their career as much as possible. Too many comics try to live a "normal" life and end up in debt. In fact, one student during the pandemic didn't get stimulus checks and used a credit card, racking up $3,000 in debt he couldn't pay back. He figured he'd be famous after taking all the classes at once. When I told him, "But I'm not famous," I could hear his eyes widen, even over the phone. You're An Independent Contractor - A One Man Business When you are stating to get paid gigs, you don't think about the money being life changing. $25 bucks here or there. Plus, so many gigs are paid in cash or Venmo, that keeping track can be a problem, and many find themselves filling the gas tank or buying Taco Bell on the way home from a $25 gig, meaning they basically break even or lose money. The other issue with comedian pay is that they are an independent contractor - therefore taxes are not taken out of their earnings. Just so you know, if you get paid under $600 you don't have to report the earnings, but if you make $600+ the venue should send you a 1099 in January and you'll pay 25% to 30%on your earnings. Hopefully, you have write-offs like food, gas, milage, streaming and newspaper subscriptions, and other items to offset your earnings so you are operating at a loss or breaking even. Turbo Tax can only do so much, so you'll need a good accountant to make sure everything you do is legal or you'll be in hot water with the IRS. You can fid them for $200 in most cases. What If I Never Get a 1099? This happens a lot, as places just ignore under $1,000 or even more, and just take you off the books. So that door deal you did for $800 becomes a ghost deal in Quickbooks. On the surface, you think you dodged a tax bullet, but in reality, you might have just hurt your chances at getting a car loan or apartment - because all that unaccounted income adds up. So when you go apply for an apartment, and you write down on the income line, you make X amount, when they ask for proof, there's no 1099 to back you up. In this case, depending on what you want to do, you can claim the money as earned income on your tax return or not report it and just hope that business never gets audited. Technically, you both are responsible, but ignorance is bliss. Yet, here's why I always claim my additional income: Let's say you apply for an apartment and you don't have W-2's or weekly check stubs that meet the minimum income, you will need your tax forms to help you. Telling a landlord "I make an extra $100 every week at a sketchy dive bar show" won't cut it. But creating a revenue line that is a binding legal document can suddenly move your income up. Don't be afraid of paying taxes later. If you are tracking your write-offs, you should be able to break even or still get a refund. The other reason to track all of this and maintain financial integrity is for when you start making real money. Too many comics I know never showed this discipline, and now they are years behind in paying taxes and they're just one day from the IRS going, "Wait! When did you start making all this additional income?" Remember, just because the IRS hasn't caught on to your fuzzy math, if the comedy club or business has to get audited, then they'll come looking for you. I literally had family members go through that scenario, You Don't Have to Pay But You Do Have to File Your Taxes I'm friends with a lot of creatives. Models. Singers. Actors. Comedians.It's shocking how many avoid taxes all together. Taxes is the LEAST SEXY topic in the world. I'm pretty sure I have lost my chance with a few women trying to help them not get in trouble with the IRS. Stupidly, while on a date. But while it might seem minor, it can hurt you financially and legally if you don't keep track and file each year. First off, it's a federal crime not to file. You don't have to pay right away, but you have to file. You could have terrible, irreversible fines, and even worse, potential jail time if they believe you are committing fraud. Secondly, you cannot qualify for a house or certain loans, and you certainly will have issues in relationships if your significant other realizes they might inherit a tax burden not worth dealing with. Third, you will lose the ability to earn unemployment, stimulus checks, and other income programs. The whole system only works if everyone pays in and when needed, the system pays out. Fourthly, it could hurt your social life and work reputation. I never paid my student loans and was garnished, meaning my job found out. And I have female friends who had guys break it off with them when they realized they were a tax liability for not paying or filing. No one wants to spend their honeymoon visiting their spouse in federal prison. Credit Cards and Debt - The Death of Comedy While I am very conservative and don't use credit cards due to the fear of owing and not being able to pay due to revenue loss or medical hinderance, I understand that some people are more disciplined or have savings that they can dip into at the end of the month to pay down the balance. With that said, if you are putting your comedy career on debt, hoping it will pay off, be wise. Spending thousands on festivals, airline tickets, hotels, and travel expenses hoping to make it big can become frustrating. Make sure you are budgeting, keeping receipts, etc. so you aren't eaten alive by the road. I like cash flowing my comedy so I don't get into a pickle, but if you feel comfortable using credit cards, then I suggest you talk to your credit union about a business card, which will help with "business expenses" that don't intermingle with "personal expenses." Because remember, if you spent $50 to enter a comedy festival, you will pay interest on it, so now it's more than you initially paid. Same with all other expenses. Final Thoughts I know this wasn't my most "exciting" article, but I feel that if you want to make this a real career, you need to to know what you didn't see coming, as I learned the hard way in 2018 and ended up owing over $5,000 because of 1099's and not keeping track of my expenses. Now, I work with great accountants and I'm on top of everything. I also have no desire to see any of you suffer. Just for the record, many of my modeling, artist. and actor friends have taken my advice to file after ignoring for years, only to find out they got FAT (Phat) refunds. I also don't want you to deal with the confusion other comics deal with. Too many of them ask me about life skills they can't ask others out of embarrassment; so I know this is valuable to many of you. Below is a one hour podcast with one of my favorite financial guru's Caleb Hammer. He's interviewing comedy phenom Hans Kim from Kill Tony fame. He went from homeless to $300,000 a yea, and he has no idea how to take care of himself. Watch it for a very entertaining hour. If you need any resources, I'm going to share a few websites and YouTube pages below that can help you. Just for the record, I'm not getting paid for advertising these pages, but they have helped me a lot and want to pay it forward. Remember, you're not alone, and financial literacy isn't that hard once you start taking steps in the right direction. TAX RESOURCES Tax Websites TurboTax - Self Tax Resource Dave Ramsey Specialists - Find a Tax Preparer Around You Budgeting Tools Rocket Money - See Where Your Money is Going Every Dollar - Budget Your Whole Income Favorite YouTube Channels Dave Ramsey - For Getting Out of Debt Caleb Hammer - For Budgeting and Creating Emergency Funds Graham Stephan - A Frugal Millennial and Great Real Estate Advice

0 Comments

Leave a Reply. |

Paul Douglas Moomjean Blog's About What's on His MindBlogging allows for me to rant when there is no stage in the moment to talk about what's important and/or funny to me. Archives

July 2024

Categories |

RSS Feed

RSS Feed